| |

Sections:

The ACA and Paying Taxes

For a tax assister and a guide for 2015 tax season filing as it relates to health insurance see Taxes (on our Financial Assistance page).

Open Enrollment

Massachusetts: Open Enrollment period is generally November 1 to January 23 for coverage beginning the following month. States who run their own exchanges have some discretion in the length of Open Enrollment- Here's NPR's list of the other 10 states plus the District of Columbia that run their own ACA sites and marketplaces.

Those seeking financial assistance for coverage, those experiencing a qualifying life event and those applying for dental coverage may apply at any time. See below.

Regular Enrollment Details:

Consumers are encouraged to update their applications with the most current information and browse their plan options. Members can remain in their same plan for the following year, if that plan is available, but if not, then members will be mapped into a similar plan. Unless a member checks out with a new plan, they will be auto-renewed into their mapped plan in late November. Members can always shop for a new plan until the end of Open Enrollment (until 12/23 for coverage starting 1/1, 1/23 for 2/1, and 1/31 for 3/1).

Those seeking financial assistance for insurance coverage can apply at any time during the year. Those ineligible for subsidies must have a qualifying life event to purchase coverage outside of open enrollment. Details:

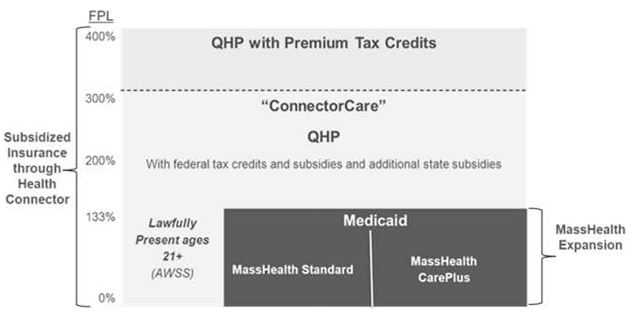

- Applicants determined eligible for ConnectorCare, MassHealth, the Children's Medical Security Program, or Health Safety Net, will be able to enroll in that coverage at any time during the year.

- Applicants only determined eligible for tax credits or determined not to be eligible for any help paying for the cost of their health insurance, must have a qualifying event that allows them to shop before the next open enrollment period.

- Dental insurance - available year round for purchase.

- Note also-those found eligible for ConnnectorCare during open enrollmentand still within 60 days of date on eligibility notice have until 60th day to enroll. (For example, applied & found eligible Jan 29, have until March 29, to enroll).

Qualifying Life Events

Qualifying Life Events allow those who do not qualify for ConnectorCare, MassHealth, the Children's Medical Security Program, or Health Safety Net to buy insurance outside of Open Enrollment. See link for details, but qualifying life events include (NOT a complete list):

- Marriage

- Birth or adoption of child

- Loss of coverage for a variety of reasons (does not include loss due to failure to pay premiums)

- Move

- Victim of domestic abuse or spousal abandonment

- See full list

Problems with an application? Contact the Connector's Ombudsman.

Overview/Key Points

Reference Materials/More Information

Special Topic - Young Adults (for details see our Young Adults Health Care Coverage page)

- Young Adults up to age 26 can stay on their parent's insurance plan

- Catastrophic Plans- People under 30 and people with hardship exemptions may buy a "catastrophic" health plan.

- College Students- Under the Affordable Care Act the state is no longer allowed to exclude from subsidized programs those who can get insurance elsewhere, and that includes college students. Colleges are now required to accept plans from the Connector or MassHealth, with a few rare exceptions.

- More information: see our Young Adults Health Care Coverage page

Special Topic- Pediatric Dental Coverage

- Though pediatric dental coverage is technically mandated, there are no penalties for families who do not purchase it.

- Because some plans in the marketplace include embedded pediatric dental coverage, while other plans require that coverage be purchased separately, there exists an underlying confusion and inconsistency. (Adult dental benefits always have to be purchased separately — because they're optional, under the law.)

- Because stand-alone dental plans are not eligible for federally-sponsored subsidies, families face an economic disincentive to buy such plans—and the most vulnerable families (namely those with particularly tight budgets) may not be able to afford them at all.

- Learn more

Special Topic - Medicare Eligibility Ends Medicaid Expansion Eligibility

-

Under the Affordable Care Act (ACA), states can expand Medicaid coverage to adults ages 19-64 earning up to 138% of the Federal Poverty Level (FPL). To date, 28 states and the District of Columbia have chosen to expand the program.

Individuals enrolled in expansion Medicaid have little or no out-of-pocket costs when accessing covered health care, prescription medications, and other Medicaid-covered services, and these individuals rarely pay a premium. When a person turns 65 or becomes eligible for Medicare under the age of 65, however, that person generally can no longer qualify for expansion Medicaid and must instead be covered under Medicare. Eligibility for full Medicaid benefits are often stricter and can count a person’s assets, whereas assets are not counted to determine eligibility for expansion Medicaid.

An important outreach/advocacy opportunity is to ensure that those eligible are aware of the Medicare Savings Programs (MSPs), all of which pay a Medicare beneficiary’s Part B premium, and automatically qualify that individual for assistance with Medicare prescription drug costs, through the Extra Help program. One of the MSPs also helps with other out of pocket costs.

Unfortunately MSPs in most states also set asset limits (though higher than for Medicaid eligibility). See the AARP Public Policy Institute report.

Additional Medicare note- Medicare B: One-Time Special Enrollment Period (SEP) for Those Who Did Not Take Medicare B Thinking They Could Get Marketplace Subsidy

Many people newly eligible for Medicare thought it would be cheaper to remain in the Marketplace with subsidies, rather than pay Part B premiums, but did not realize that their Medicare Part A eligibility made them ineligible for premium subsidies, also called Advance Premium Tax Credits (APTC). When they realized their mistake, they were past their initial enrollment period and could only enroll in Part B during a General Enrollment Period, often incurring Part B late enrollment penalties.

For a limited time, these individuals were able to apply for equitable relief that gave them a Special Enrollment Period (SEP) to enroll in Part B and Part B late enrollment penalties did not apply.

The application deadline for this SEP WAS March 31, 2017.

Learn more.

Other Topics/ACA in the News

Older articles:

The 2014 Transition Period from Mass Plan to Full ACA Compliance

- Applying:

Learn more about Open Enrollment.

- MGH patients should apply through Patient Financial Services.

- Non-MGH applicants can call 1-877-MA-ENROLL (1-877-623-6765), TTY 1-877-623-7773 or visit a Connector office: 133 Portland Street, 1st Floor, Boston or 146 Main Street, Suite 201/202, Worcester. Or see The Connector's website for local Health Connector Navigators or Certified Application Counselors. Or see the Contact List (phone & fax).

- More: State Health Connector Website Woes Continue (February 2014)

- See more (older) coverage on The Boston Globe coverage of The Connector's website woes.

- Massachusetts Temporary Health Coverage- due to ongoing problems with the state's health care coverage website, the state offered temporary MassHealth coverage to those applying for subsidized coverage while the state could not process their application. By now members should all have transitioned to other forms of coverage.

- ACA Transition Provider Toolkit-

Guide to determine whether a person who is currently enrolled in some form of subsidized health coverage may experience a change in coverage under the Affordable Care Act transition. It will tell you what coverage they will likely transition to, and whether he or she should be automatically moved to a new program, needs to re-apply or will experience no change.

- PHS-Specific Materials

- PHS Transition Guide - grid that explains what coverage individuals will transition to, whether they need to actively apply, and what coverage they should select if they wish to continue to receive care at MGH/Partners.

- Post Transition: PHS ACA Transition for 1/1/14: State Health Insurance Programs you may see (valid through 3/31/14.) - a tool that explains each category, the plans we accept, and how you should be directing patients in that group.

- Continuity of Care- MassHealth CarePlus- Many of our patients have been auto-assigned to a MassHealth CarePlus plan that we do not accept (for MGH this means anything other than NHP). Patients may switch plans, but the change does not take effect until the first of the month. The health plans MUST allow CarePlus patients assigned to plans not accepted by their current providers to continue care for 30 days after auto-assignment. (Applies to existing pts only. we cannot accept new pts.)

- This does NOT apply to Network Health Medicaid patients who are NOT CarePlus and just never switched their plan. They can switch plans anytime if they want to continue to come to us for care.

- Most of the patients who need to take advantage of this will be CeltiCare patients. CeltiCare’s process is as follows:

- In the first 30 days after auto-assignment, members can see non-participating specialists and PCPs without a special prior authorization

- After 30 days, they would need a “Transition of Care Auth” to continue services unless the member changes their plan

- All services that would normally need an authorization would need to have a prior authorization even in the first 30 days

- We assume the process will work similarly with our other non-contracted CarePlus plans like Network Health and BMC HealthNet, but will pass along further details if they become available.

2010 Materials

Law Summary- MGH Community News, March 2010

Components of Law & Special Issues

- Patient's Bill of Rights - Lifetime & Dollar Limits - MGH Community News, June 2010

- What National Health Reform Means in MA - MGH Community News, April 2010

- Early Retirees Get Health Care Boost - MGH Community News, May 2010

- Health Insurers to Ban Recision - MGH Community News, May 2010

- Donut Hole Discount Program - MGH Community News, May 2010

- Medicare- Thousands to Receive Coverage Gap Rebate - MGH Community News, May 2010

- Some Families Will Face Wait to Cover Young Adults - MGH Community News, May 2010

- The CLASS Act – Long-Term Care Insurance - MGH Community News, April 2010

-

Law Unclear on Coverage of Sick Kids - MGH Community News, April 2010

- Health Reform Includes Pilot Home Visiting Program - MGH Community News, July/August 2010

- Law Requires Menu Labeling - MGH Community News, March 2010

- Affordable Care Acts Medical Loss Ratios Released - MGH Community News, March 2010

- Editorial: "In Medicine the Power of No"; Success of Health Reform depends on it - MGH Community News, April 2010

Opinion on the Affordable Care Act

|